The Evolving Landscape of Home Improvement Stocks Amid a Changing Economy

In today’s fast-paced world of investments, home improvement stocks have become a hot topic among investors who are eager to capitalize on the surge in consumer spending on DIY projects and home renovations. As trends in housing markets and consumer behavior shift, companies like Home Depot, Lowe’s, and Masco have drawn significant attention due to their high trading volumes and cyclical performance. In this opinion editorial, we take a closer look at the factors driving growth in the home improvement sector and share insights on which stocks might be worth watching for those looking to invest in the future of home renovation and maintenance.

Investors are increasingly fascinated by the opportunities in this sector. With headlines promoting the idea of capitalizing on modern economic conditions, understanding the subtle details behind these stocks is super important. Sharpening our understanding of this market involves examining the key players, evaluating cyclical trends, and considering the financial side of home renovation. The following discussion will explore each of these areas in detail.

Understanding the Appeal of Home Improvement Stocks

Consumer Spending on DIY Projects and Housing Renovations

The rise of DIY projects and home renovations in recent years has not only reshaped living environments but also created a surge in consumer spending. Homeowners who once outsourced everything now increasingly choose to roll up their sleeves and take on projects themselves, leading to elevated sales in building materials, tools, appliances, and home improvement products. This change in consumer behavior is evident in the stock performance of home improvement giants like Home Depot and Lowe’s, which regularly see peaks in trading volumes whenever seasonal trends or housing market fluctuations occur.

Several factors contribute to this consumer shift:

- Increased remote work has led to more home modifications as individuals seek comfortable spaces.

- Rising real estate prices have encouraged homeowners to upgrade their existing properties rather than move.

- The growing popularity of sustainable and energy-efficient upgrades has boosted demand for modern tools and materials.

As these trends continue to shape the market, investors are looking to better understand how these subtle parts affect stock performance and the overall reliability of home improvement companies in today’s economy.

Stock Performance: The Cyclical Nature of Home Renovation Companies

One of the key observations in this sector is the cyclical nature of home improvement stocks. Much like the twists and turns in a long renovation project, these stocks experience periods of rapid growth followed by occasional slowdowns. Many factors contribute to this pattern:

- Economic cycles: When the economy is booming, consumers have more disposable income, which fuels spending on home improvements. Conversely, during economic downturns, investment in home renovations may experience a temporary dip.

- Interest rates: Changes in interest rates can influence borrowing costs, which directly affect big-ticket renovations and home improvement projects.

- Seasonal trends: Certain times of the year naturally spur higher spending on outdoor and indoor improvements. For example, spring and summer are peak times for landscaping and remodeling projects.

This cyclical behavior is not necessarily a negative trait; rather, it reflects a market that responds organically to shifts in consumer spending and broader economic dynamics. Investors who understand these trends can better time their entry and exit points, thereby optimizing their portfolios.

Examining Key Players in the Home Improvement Stock Market

Home Depot: Leading the Charge in Home Renovation

Home Depot is arguably the cornerstone of the home improvement retail sector. Operating both in the United States and internationally, Home Depot offers a comprehensive range of products, from building materials to décor items. This retailer not only supplies high-quality products but also provides installation services for a whole host of home improvement projects. Whether it’s updating a kitchen, installing new windows, or enhancing the landscaping, Home Depot is positioned to meet diverse consumer needs.

Many investors are drawn to Home Depot due to its robust market presence and its ability to weather economic fluctuations. The fine points of its business strategy include:

- Providing a broad product range that appeals to both DIY enthusiasts and professional contractors.

- Maintaining a strong online presence that complements its brick-and-mortar stores.

- Offering installation and maintenance services that add an extra revenue stream.

Despite occasional nervous moments in the market, Home Depot remains a staple for investors who trust in its strategic resilience. Even if the market experiences some nerve-racking periods, its consistent performance makes it a super important component of a diversified portfolio.

Lowe’s Companies: A Competitive Alternative with a Diverse Product Range

Lowe’s Companies stands as a significant competitor to Home Depot, with a strong focus on making home renovations accessible to a broad audience. With its wide portfolio of construction, maintenance, remodeling, and decorating supplies, Lowe’s caters to a similar clientele while differentiating itself in key areas.

The value in Lowe’s comes from several distinguishing factors:

- Geographical reach: Serving a large market in the United States, ensuring a wide customer base.

- Service offerings: Providing various home improvement services that enhance its product sales.

- Store experience: Emphasizing personalized customer service which fosters brand loyalty.

Investors watching Lowe’s are particularly interested in how its business model adapts to both online and offline consumer behaviors. As retail trends continue to shift, Lowe’s ability to make its store experience increasingly engaging could be a key advantage in the years ahead.

Masco Corporation: Blending Design and Functionality in Home Improvement

While retailers like Home Depot and Lowe’s provide the access points to home renovation materials, manufacturers such as Masco Corporation play an essential role in the building material supply chain. Masco primarily focuses on designing, manufacturing, and distributing home improvement and building products. Its broad portfolio includes items ranging from plumbing fixtures to sophisticated plumbing system components.

Investors often point to Masco as a company that demonstrates the subtle parts of a successful manufacturing approach in the home improvement sector. Its business has several appealing aspects:

- Innovative design: Constantly updating its products to meet modern demands.

- Global presence: Operating not only in North America but also in international markets.

- Sustainability efforts: Strengthening its reputation by incorporating eco-friendly solutions into its product lines.

With these strengths, Masco is well-positioned to continue influencing the home renovation market, even if the road ahead is filled with tricky parts and tangled issues that every business endures.

Medallion Financial Corp.: Financing the Home Improvement Boom

Not all opportunities in the home improvement market are about physical materials and retail. Medallion Financial Corp. offers a unique angle by providing dedicated loans for home improvement projects. This specialty finance company operates in multiple segments, including home improvement lending, making it an essential cog in the ecosystem of home renovations.

Key highlights of Medallion Financial include:

- Tailored financing: Offering loans specifically designed for window upgrades, siding, roof replacements, and other renovation projects.

- Diversification: Operating through various lending segments such as recreational, commercial, and taxi medallion lending.

- Market sensitivity: Its financial products tend to reflect the general economic sentiments among consumers looking to invest in their homes.

While the lending side of the home improvement market might seem intimidating at first glance, Medallion Financial’s specialized approach is a key detail for investors seeking exposure to the broader home improvement trend without directly investing in retail or manufacturing companies.

Jewett-Cameron Trading and ToughBuilt Industries: Niche Players with Unique Contributions

Two other notable names in the home improvement arena include Jewett-Cameron Trading and ToughBuilt Industries. While they may not have the brand recognition of the larger players, both companies contribute significantly to the sector by supplying specialized building materials and innovative construction products.

Jewett-Cameron Trading focuses on providing value-added building materials to major home improvement centers, particularly concentrating on the repair and remodeling segment. This specialization enables the company to offer products that directly cater to the needs of residential projects, thereby positioning it as an important supplier in a very competitive market.

ToughBuilt Industries is known for its focus on construction and home improvement products that are built to last. Offering items such as tool pouches, tool rigs, tool belts, and storage solutions, ToughBuilt not only serves the needs of DIY enthusiasts but also professional contractors who demand durable, reliable products for daily use. Its innovative design and commitment to quality have secured its place among those notable stocks to keep an eye on.

Key Considerations When Investing in Home Improvement Stocks

Evaluating Consumer Trends and Economic Cycles

Understanding consumer behavior is a super important first step in evaluating home improvement stocks. As more people embark on DIY projects or invest in significant home upgrades, the demand for related products inevitably rises. However, it is equally key to consider that these trends often follow economic patterns that oscillate with booms and slowdowns.

Here are a few ways investors can gain insight into consumer trends:

- Monitor housing market reports: Regular updates on home sales, mortgage rates, and regional trends can provide clues about upcoming spikes in home improvement demand.

- Keep an eye on seasonal variations: Recognize that certain times of the year trigger higher spending on outdoor projects, while winter seasons may see a focus on indoor upgrades.

- Consider demographic shifts: Changes in population dynamics, such as the increase in remote workers, can have a lasting impact on consumer spending patterns related to home improvements.

By considering these factors, investors can better figure out which stocks are likely to perform well and which might be more vulnerable to downturns in the cycle. Paying attention to these little twists and subtle details can make all the difference between a good investment and one that struggles when market conditions change.

Financial Health and Earnings Reports: Gauging Market Stability

When assessing home improvement stocks, it is critical to dive into the financial details of each company. Earnings reports, revenue growth, profit margins, and debt levels are all key indicators of a company’s ability to weather economic ups and downs. For investors, these metrics not only offer insights into current performance but also provide guidance on future stability.

Consider the following table for a quick snapshot of what investors might look for:

| Company | Key Strengths | Potential Challenges |

|---|---|---|

| Home Depot |

|

|

| Lowe’s |

|

|

| Masco Corporation |

|

|

Reviewing such detailed information enables investors not only to appreciate the strengths each company brings to the table but also to recognize the twists and turns that might impact their earnings momentum in the future. Being proactive and well-informed can help alleviate some of the overwhelming mysteries of the stock market.

Regulatory and Market Risks: Being Prepared for the Unexpected

As with any sector, the home improvement industry is not immune to broader market risks or regulatory changes. New policies affecting trade, labor, or the environment can quickly shift market dynamics. Investors must remain alert to these potential pitfalls and be ready to make adjustments as necessary.

Some of the key challenges include:

- Trade policies: Changes in tariffs and trade agreements can affect the cost of imported materials, thereby impacting profit margins.

- Environmental regulations: New sustainability standards may force companies to adopt more expensive production methods, although these can also open the door to eco-friendly innovations.

- Consumer confidence: Shifts in consumer sentiment can lead to abrupt changes in spending on home improvement projects.

Investors can mitigate these risks by staying informed through regular updates, diversified holdings, and by keeping a close eye on policy adjustments that might influence the home improvement landscape.

The Future of Home Improvement Stocks: Trends and Predictions

Adapting to a Shifting Consumer Landscape

Looking ahead, the home improvement sector is poised for further transformation as technology and consumer preferences continue to change. With the rise of smart home technologies, energy-efficient appliances, and sustainable building materials, the sector is entering an era of innovation. Companies that take a proactive approach to incorporating these trends will likely see renewed investor interest.

Key trends influencing the future include:

- Integration of technology: Innovations in smart home systems are revolutionizing how consumers manage their homes, making it a burst of opportunity for companies that adapt quickly.

- Sustainability: As consumers become aware of their environmental impact, there is growing demand for sustainable, eco-friendly products—from low-VOC paints to energy-efficient lighting.

- Customizable home solutions: The modern homeowner looks for personalized and cost-effective solutions, meaning companies that innovate in product design will have a competitive edge.

This shifting landscape may appear a bit intimidating at first, given the tricky parts involved with constant innovation. However, by focusing on the core values of quality, customer service, and adapting to market feedback, home improvement companies have a strong chance to not only stay afloat but thrive.

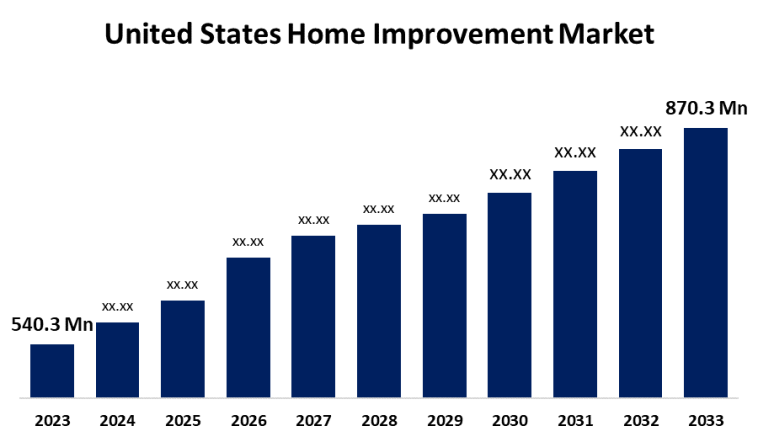

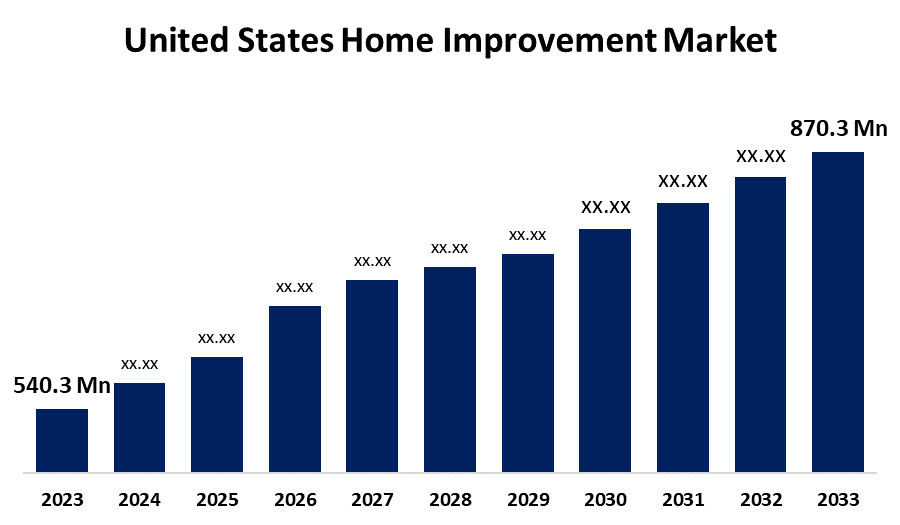

Market Predictions and the Role of Long-Term Investments

Many financial experts assert that home improvement stocks, given their cyclical nature and sensitivity to economic conditions, represent a valuable long-term investment for those with patience. Market volatility may create nerve-racking periods; however, the potential for growth remains super important in a robust economy where homeowners continue to invest in significant upgrades.

Investors should consider a few key points when planning their long-term strategy:

- Diversification: Balancing investments in large, well-known companies like Home Depot and Lowe’s with niche players such as ToughBuilt Industries can mitigate risk.

- Regular performance reviews: Staying engaged with quarterly earnings reports and stock performance assessments can help investors figure a path through fast-changing market trends.

- Economic indicators: Monitoring interest rates, housing market conditions, and consumer confidence can provide an early warning signal for when to adjust investment strategies.

Given the potential rewards and the opportunity to capitalize on a growing trend, many believe that maintaining a stake in home improvement stocks is a smart investment move. By taking a closer look at both the big players and the lesser-known innovators in the field, investors can build a resilient portfolio.

Investment Strategies: Balancing Growth and Stability in Home Improvement

Building a Diversified Portfolio for Home Renovation Stocks

A well-rounded investment strategy in the home improvement sector should balance growth potential with stability. If you are considering dipping into home improvement stocks, the first step is to build a diversified portfolio that includes companies across different segments—ranging from retail giants and product manufacturers to specialized lenders.

Here is a sample breakdown of how you might consider approaching your investments:

| Segment | Example Companies | Reason to Invest |

|---|---|---|

| Retailers | Home Depot, Lowe’s | Broad product offerings and stable market presence. |

| Manufacturers | Masco Corporation | Innovative product design driving consistent performance. |

| Specialized Finance | Medallion Financial Corp. | Dedicated loans powering renovation projects. |

| Niche Suppliers | Jewett-Cameron Trading, ToughBuilt Industries | High-quality building materials with tailored market focus. |

This strategy not only spreads risk but also allows investors to benefit from the diverse revenue streams within the broader home improvement market. Having a mix of established and smaller, innovative companies can help cushion the portfolio during periods of economic turbulence while still ensuring growth during economic booms.

Staying Informed and Adapting Your Investment Approach

The ability to find your way through the ever-changing environment of home improvement stocks requires continuous learning and staying informed on market trends. Subscribing to financial newsletters, following quarterly earnings reports, and keeping track of key market indicators are all super important steps for responsible investors.

Here are some practical tips for managing your investment strategy:

- Consider setting up alerts or using stock screeners to track performance trends.

- Engage with informed communities and discussion forums where market updates are frequent.

- Review detailed research reports that break down financial statements and market movements.

- Remind yourself that market cycles include both upward and downward movements, so maintain a long-term perspective.

Accepting that the market is full of problems and subtle details can help investors reduce the impulse to make hasty decisions. This steady approach can be one of the best practices for making your way through volatile market periods.

Conclusion: Embracing the Opportunities in Home Improvement

Why Home Improvement Stocks Remain a Compelling Investment Choice

Home improvement stocks offer a unique blend of stability and growth potential. With an ever-evolving landscape influenced by changing consumer habits, technological advancements, and economic cycles, companies like Home Depot, Lowe’s, Masco, and even niche players such as ToughBuilt Industries embody the promise of a resilient market. While occasional market fluctuations and regulatory twists and turns may seem overwhelming, a well-researched and diversified strategy can help investors reap long-term benefits.

Embracing these opportunities means staying proactive, continuously adapting your strategy to market conditions, and keeping a finger on the pulse of consumer trends. Whether you are a seasoned investor or new to the market, the home improvement sector reflects a dynamic and promising field thanks to its integral role in everyday living and economic recovery.

Key Takeaways for the Savvy Home Improvement Investor

In summary, here are some of the super important points to remember when considering investments in home improvement stocks:

- Cyclical Patterns: Understand that these stocks follow economic cycles and seasonal trends, which can be managed through diversification.

- Diverse Market Representation: From big box retailers like Home Depot and Lowe’s to niche players like ToughBuilt Industries, a balanced portfolio can safeguard against market volatility.

- Consumer Trends: Paying attention to how shifts in consumer spending, remote work, and sustainability affect demand can offer key insights for timing your investments.

- Financial Health: Regularly review earnings reports and balance sheets to ensure your investments remain secure during both bullish and bearish periods.

- Regulatory and Market Risks: Stay updated on policy changes and trade shifts that could impact supply costs and pricing strategies.

As market uncertainties continue to emerge from time to time, maintaining a firm grasp on the core drivers of growth in the home improvement industry can empower you to make decisions with confidence. Remember that every market—like every renovation project—requires planning, adaptability, and a keen eye for the fine details.

In conclusion, home improvement stocks have firmly established themselves as a compelling investment opportunity in a landscape where consumer behavior and market dynamics are constantly evolving. Whether you are drawn by the reliability of well-known brands or the potential growth of specialized niche companies, the rewards of investing in this sector lie in the ability to steer through its tricky parts and unexpected challenges with confidence and diligence.

So, as you set your sights on future investments, take a moment to appreciate the myriad ways in which the home improvement sector continues to reshape the way we live and invest. With careful planning, ongoing research, and a diversified approach, you can harness the benefits of this dynamic market to build a stronger, more resilient portfolio for the future.

Originally Post From https://www.marketbeat.com/instant-alerts/home-improvement-stocks-to-keep-an-eye-on-october-9th-2025-10-09/

Read more about this topic at

Momentum Construction – Custom Remodeling & Design

Home Improvement Company – Roofing, Siding, Window Repair